I listened on Monday to a discussion at the Resolution Foundation of a new report, In Credit. The participants seemed on the whole convinced by the proposition that UC has simplified the system, that the process of digitisation has worked well (especially in the pandemic) and that the central issues now concerned the adequacy of the benefits rather than the design of the system. At the same time, reports from other organisations point to serious structural problems with the benefit. An outstanding report from CPAG goes methodically through the processes of claiming, decision making, official communications and failures in the management of disputes. And research from Bath University’s Institute for Policy Research criticises the rigidity of the assessment system and the drastic volatility and unpredictability of the income that is being provided. “Monthly fluctuations in UC were ubiquitous, frequent and sometimes very large. ”

Someone has to have got this wrong, and in my view, it’s the Resolution Foundation. They acknowledge that there were ‘teething problems’ at the outset. It’s much worse than that. The early years were a complete disaster, which is why the programme had to be ‘reset’ and massively overspent, but the system failed then, and has failed ever since, to meet any of its declared objectives. I’m not going to go through everything I’ve said about this on this blog, but here are a few salient points.

The declared aims of Universal Credit have shifted frequently over time, but in general they were claimed to be:

- the simplification of the system

- reducing fraud and error,

- reducing worklessness, and

- improving work incentives.

Other objectives have included:

- reducing the cost of the welfare system

- rewarding work and encouraging personal responsibility

- reducing poverty

- smoothing transitions in and out of work

- improved efficiency through automation

- personalising benefits through a tailored response.

Every one of those objectives has been a failure. I’ve previously presented evidence about each of them. There have been critical reports from the House of Commons, the House of Lords and the National Audit Office, and specific rebuttals of the positive spin put on them by the DWP.

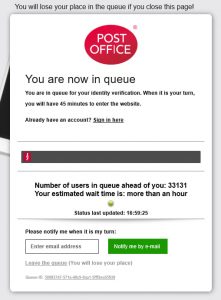

The main thing to add since I made that argument has been the question of how things changed with the pandemic. According to the Resolution Foundation report, “the system garnered praise during the pandemic for its ability to cope with a huge increase in claimant numbers with minimal delays.” I seem to remember something different. The first thing is that the social security system had coped before with massive increases in claimant numbers. The second point is that in the early stages of the pandemic, the system didn’t cope: it locked up. Here’s a reminder.

When UC eventually did catch up, it was at the cost of substantial delay, uncertainy, error and fraud.

So – how has UC fared? It has failed to simplify. Its digitisation has been clumsy and inappropriate to claimants’ circumstances. As for ‘incentives’, the policy-makers have lost sight of the main purposes of the benefits system, which have little do with work. And, in the process, we have lost sight of the need for a basic benefit that can at least ensure that people are not malnourished, destitute or in despair.