The DWP’s new Green Paper, Modernising support for independent living, could well be the most alarmingly misconceived document on social security I have witnessed during the tenure of the Conservative government, which in the era of Universal Credit is saying something. It displays a basic lack of understanding of how benefits for disability work and what they are there for.

Personal Independence Payment (PIP) was introduced in 2013 to provide non-means tested cash payments to disabled people and people with health conditions to help them live independent lives.

A brief history is in order. PIP was not a fundamental replacement of the previous system. It was a rebranding of Disability Living Allowance, or DLA, which itself brought together two existing benefits for people of working age: Attendance Allowance and Mobility Allowance.

None of those four was designed to promote independent living. That was the job of a completely different set of systems, initially pioneered by the Independent Living Fund, subsequently incorporated into the Griffiths reform of community care, and currently taking the form of personalised or ‘self-directed support’. There is a limited overlap, to the extent that people who are supported by community care may also get financial benefits, but most of the users of either system are not covered by the other.

PIP … is often described as an ‘extra costs benefit’. It is paid at various rates depending on the level of functional impact of a person’s disability or health condition.

Well, that was how both DLA and PIP were presented politically – but it’s not what they do, or what they were designed to do. The criteria for awards do not, and never have, depended on extra costs. They focused on the severity of the disability, which is something quite different. (The tenuous link to costs is explained in the DWP’s Equality Analysis on PIP, undertaken in 2017:

“PIP is a payment that is intended to be broadly proportionate to the overall need of a claimant. The greater someone’s need, all else being equal, the greater the cost they will face as they go about their daily lives.”)

If the benefits were not about costs, what were they supposed to be doing instead? That was made explicit at the time of the introduction of benefits for people with disabilities in the 1970s. It had become clear that people with disabilities, regardless of their status in other respects, suffered disadvantage throughout their working lives – not necessarily because they had additional costs, but because they were disabled. Alf Morris explained in Parliament:

“It is not only a question of finance we are discussing, but also the dignity of disabled people. … This is only one stage towards improving the financial status, and therefore the dignity, of every one of our severely disabled fellow citizens.”

The logic of not means-testing the benefits was that this disadvantage affected everyone with a disability.

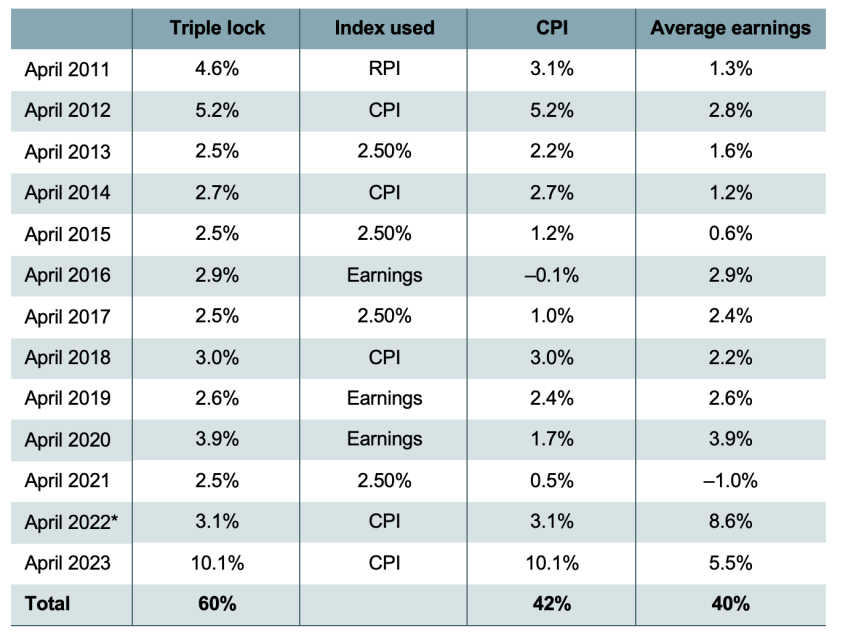

Additional note, 23rd June This graph, from a report by the Resolution Foundation, shows what PIP actually does. Its principal role as a benefit is to do just what the benefits it was based on were meant to do: not meeting extra costs, but offering additional support for persistent low income.

In the United Kingdom, we have had a predominantly cash transfer system for extra costs since the introduction of Attendance Allowance and Mobility Allowance in the 1970s.

These were not ‘extra costs’ benefits, and no assessment was made to relate them to costs. (I should perhaps add that despite the name, Attendance Allowance was not given for attendance, but for severe disability.) In the past, there were two ‘extra costs’ benefits attached to Supplementary Benefit and Income Support: those took the form of “Exceptional Circumstances Additions” and “Exceptional Needs Payments” when they were part of Supplementary Benefit, and became ‘premiums’ when Income Support was introduced. Things have moved on since; the ‘legacy benefits’ are being eradicated, and these provisions are going with with them.

We know from research that people often use their PIP payments on core household expenditure (such as utility and housing costs). We also know that some disabled people view their PIP award as compensation for being disabled rather than as an award for extra costs.

This is one of the few statements in the review that recognises how social security actually works. Benefits are delivered as cash so that people can choose how to use them, and cash is ‘fungible’ – it gets lumped together with other cash.

We also know a certain amount about what applicants think about the disability benefits. One of the primary findings about DLA, shortly before it was renamed, was that applicants didn’t have much idea of what the criteria were, and if they were receiving other benefits were likely to think they ought to have a crack at it. The takeup of these benefits has been weak; people with disabilities do not necessarily think of themselves as ‘disabled’, and some say that they are disabled ‘sometimes’. It has not helped that the benefits have been lumped into a single, supposedly ‘working age’ benefit, and that assessments have often focused inappropriately on someone’s ability to work. There is a good case for smaller, more clearly defined benefits that might actually make some sense to the people who receive them – and, given the level of incomprehension that this DWP paper reveals, to the people responsible for delivering them.

We would like to understand whether some people receiving PIP who have lower, or no extra costs, may have better outcomes from improved access to treatment and support than from a cash payment.

This is disingenuous. If there is no cash payment, those people will be worse off financially, as the evidence mentioned in the previous quotation makes clear. That will be true regardless of whether their health care is enhanced.

We want to hear how the welfare system could be improved by exploring new approaches to providing support. These include:

- Moving away from a fixed cash benefit system so people can receive more tailored support in line with their needs.

- Moving towards a better join up of local services and a simpler way for individuals to access all forms of support and care, whilst reducing duplication, to better meet the needs of people with health conditions and disabilities.

- Exploring alternative ways of supporting people to live independent and fulfilling lives. This could mean financial support being better targeted at people who have specific extra costs, but it could also involve improved support of other kinds, such as physical or mental health treatment, leading to better outcomes.

In every particular, this refers to the objectives of the system of social care, not benefits for disability. The thorough-going replacement of the objectives of the existing benefit system by the system of community care could potentially imply an expansion of community care – but it also implies, no less, the virtual abolition of the system of social security benefits for people with disabilities.